Nuclear Research Centres and Research Reactors :

2012 to 2016

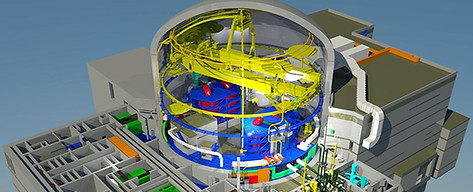

Owners Engineer Services: Design and construction of the Jordan Research and Training Reactor (JRTR), Jordan

Client: Jordan Atomic Energy Commission (JAEC)

In September 2012, JAEC signed a contract with NucAdvisor and its consortium as Owners Engineer to assist JAEC in the oversight of the Constructor:

-

For the design, project management, licensing as well as onsite activities including procurement, construction, installation, testing, receiving equipment and commissioning

-

To ensure the preparation of the JAEC staff, by on-the-job transfer of experience, to be ready to operate the JRTR;

-

To run several independent neutronic and thermal-hydraulic calculations on the JRTR core to validate the safety of the design;

2023 - ongoing

Owners Engineer Services for the supervision of the procurement of fresh fuel assemblies for the Jordan Research and Training Reactor, JRTR (Jordan)

Client: Jordan Atomic Energy Commission (JAEC)

In October 2023, JAEC signed a contract with NucAdvisor to assist JAEC in the oversight of the procurement contract of new fresh fuel assemblies.

2023 - 2024

Feasibility study for a radioisotope production facility (ARTHUR) in Wales

Client: Welsh Government

NucAdvisor is conducting for the Welsh Government the full feasibility study for the radioisotope production facility ARTHUR (Advanced Radioisotope Technology for Heath Utility Reactor). The feasibility study report is based on the format and structure of IAEA guide NG-T-3.18.

The following main sections are included in the feasibility study report:

-

Technical Requirements and Capability

-

Planning, Licensing and Safety

-

Programme Management

-

Business Case Information

-

Ownership Options

-

Operations and Maintenance

-

Decommissioning and Waste Management

2023 - 2024

Gateway Review on the Feasibility Study Report on the new Multi-Purpose Reactor Project (South Africa)

Client: NECSA

The South African Nuclear Energy Corporation SOC Limited (NECSA) has requested an Independent Gateway Review on the Feasibility Study Report on the new Multi-Purpose Reactor Project.

The objectives of the project are:

-

Determine the extent, to which the project is likely to deliver;

-

Evaluate the expected benefits within the declared cost, time, and performance envelope;

-

Determine the affordability of the project;

-

Assess the Value for Money of the project, the optimum combination of whole-life costs and quality to meet users’ requirements; and

-

Provide a critical analysis of the project’s shortcomings and recommendations and guidance to improve the project’s feasibility.

2019 - 2024

Owners Engineer Services for the Design and Construction of a Research Center (Bolivia)

Client: Agencia Boliviana de Energia Nuclear

Since 2019, NucAdvisor is providing Owner’s Engineer (OE) services to the Agencia Boliviana de Energia Nuclear (ABEN) is constructing a research centre in El-Alto. The centre will include a cyclotron, a multipurpose irradiation facility and a research reactor.

NucAdvisor services include:

-

Nuclear Research and Technology Center design review

-

The implementation of an effective project management organization, including tools

-

The implementation and follow-up of an efficient and reliable Quality Management of the Project, covering all parties

-

Risk management

-

Monitoring and follow-up on the Contractor procurement procedures

-

Construction and manufacturing inspection onsite and offsite

-

Support in commissioning and final project handover

2023 - ongoing

Owner's engineer services for the electro-mechanical erection of the LPRR components (Saudi Arabia)

Client: King Abdulaziz Center of Science and Technology (KACST)

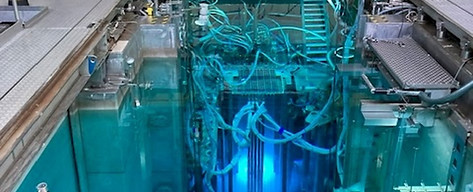

King Abdulaziz City for Science and Technology (KACST) is investing in a low power research reactor which is under construction in Riyadh.

The Low Power Research Reactor (LPRR) is the first research reactor in Saudi Arabia and it is designed as a multipurpose low power reactor to support a demanding training and human resources development plan and become a tool for research and development.

The reactor is of an open-pool design cooled by natural circulation of light water with a power rated at 30 kW. After civil works have been completed, the project enters the phase of electro-mechanical erection for which NucAdvisor will provide supervision services.

2020 - 2021

Safety-related support services for the Low Power Research Reactor LPRR (Saudi Arabia)

Client: King Abdulaziz Center of Science and Technology (KACST)

King Abdulaziz City for Science and Technology (KACST) is a Saudi Arabia government institution that supports and enhances scientific applied research. The Nuclear Science Research Institute (NSRI) of KACST is nearing completion of a research reactor constructed in Riyadh.

NucAdvisor supported the LPRR project team and conducted a review of Safety and Licensing documents, defining the set of recommendations for licensing documentation, and highlighting the main strengths and weaknesses of the design and operation.

2018 - 2019

Security-related support services for the Low Power Research Reactor LPRR (Saudi Arabia)

Client: King Abdulaziz Center of Science and Technology (KACST)

King Abdulaziz City for Science and Technology (KACST) is a Saudi Arabia government institution that supports and enhances scientific applied research. The Nuclear Science Research Institute (NSRI) of KACST is nearing completion of a research reactor constructed in Riyadh.

NucAdvisor supported the LPRR project team through consultancy services and defined and assess malevolent acts which could result in exposure to, or dispersion of radioactive materials.

2015 - ongoing

Owners Engineer Services for the Design and Construction of the PALLAS Research Reactor (Netherlands)

Client: PALLAS

Tractebel Engineering, teaming with NucAdvisor, is delivering Owner’s Engineer (OE) services for the new PALLAS research reactor, which aims to replace the existing High Flux Reactor (HFR) operated since 1961

-

Support in the definition of the PALLAS Business case for medical isotopes production

-

Preparation and review of reactor specifications, contractual conditions for PALLAS international call for tender, bid assessment support

-

Safety/licensing studies regarding Dutch safety requirements specificities

-

Participation in Design reviews

-

Technical information management system implementation PLM—BIM

-

Support to project organization for interface management, value engineering development

-

Project management support

2016 - 2017

Support to Business Case for PALLAS project (Netherlands)

Client: PALLAS

.jpg)

As part of the implementation of the PALLAS project, both technical and financial aspects are moving forward in parallel, with technical decisions taken on the reactor design having an impact on the overall business case and vice-versa. Obtaining accurate data, forecasts and estimates are vital inputs to ensure the accuracy of the business case and obtain support for the project from potential stakeholders.

NucAdvisor provided targeted support to the Business Case & Financing (BC&F) project, through specific expertise on the global research reactor market, as well as the associated economic aspects.

Based on a series of design assumptions, different detailed evaluations were prepared on:

-

Capital expenditures

-

Operational expenditures

-

Revenues

-

Owners’ costs

2013 - 2016

Financial and Legal Advisory Services for New Nuclear Program, Republic of South Africa

Client: DoE

As part of the South African Nuclear New Build Program, NucAdvisor developed financing and localization models to enable the RSA to make informed decisions on the structure of its new Nuclear Operating Company and the impact on the national economy.

-

Financing Schemes of NPP Projects, with an emphasis of Owner-Operator Structures, Investors and Funding Models through international overview of projects developed in the last two decades;

-

NPP Business Models analysis, built around a deep analysis of international cost of Nuclear Power for 18 countries and a LCOE (Levelized Cost of Electricity) comparison with other Energy Sources;

-

NPP Localization Economic Impact, where a Localization Calculation Model was built to enable the complete estimated impact of the NPP Program on local Industry and National Economy.

2021 then 2023 – 2024

Audits on the risks and costs of the EPR2 programme

Client: French Government

NucAdvisor and Accuracy were selected by the French Government to provide their insights and expertise on the economic feasibility of a new nuclear power plant construction program in France. This request is based on the comprehensive documentation and data provided by EDF regarding the construction program of six EPR2.

The audit has been structured around three key themes:

-

Task 1 focuses on conducting an audit of the construction specifications and underlying construction schedules to ensure there are no risks associated with the project.

-

Task 2 involves a thorough counter-assessment of the risk analysis to determine its potential impact on construction costs and schedules. Lastly,

-

Task 3 entails a comprehensive assessment of the full cost of the new nuclear power plant.

In 2023, NucAdvisor and its partner Accuracy performed a deep update of the program risks and costs upon request of DINN (Délégation Interministérielle au Nouveau Nucléaire).

2022

Comparative analysis of models for the delivery of O&M regime at nuclear power plants

Client: Confidential

The IAEA recommends that owners of proposed large nuclear power plants identify their choice of operating model early in the development period. In line with this recommendation, a national nuclear utility requisitioned a study. NucAdvisor was dominantly involved on:

-

Defining the Operator

-

Fundamentals of the Operating Company

-

Operator role at different stages

-

-

Comparative Analysis of various operator models

2022

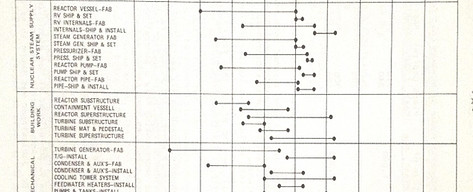

Long Lead Item Study

Client: Confidential

Long lead items (LLI) can significantly impact the overall project schedule. They are typically critical components or equipment with a long procurement, fabrication, or delivery lead time. Therefore, they must be ordered years before they will be required on the construction site. NucAdvisor provided a study to a newcomer country:

-

Defining common NPP long lead items

-

Managing Long Lead Items and Programs

-

Selected long lead learnings from other projects

-

Conclusions and early steps in LLI management

2024

Detailed assessment of a new build project schedule

Client: Confidential

The client requested a high-level independent analysis to assess the risks, gaps, and necessary modifications or further evaluations within their project schedule. This analysis aimed to integrate critical milestones from both the EPC contract and the client’s obligations related to the accompanying infrastructure. It considered the commitments required well in advance, interactions with regulatory authorities, and the practicality of adhering to the proposed timeline. Additionally, the study evaluated the organization's readiness to advance to the final investment decision stage.

2024 - ongoing

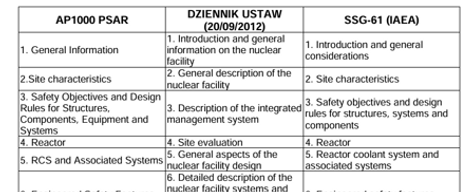

Support the preparation of the Preliminary Safety Analysis Report and to conduct an independent verification of safety analyses

Client: Polskie Elektrownie Jądrowe sp. z o.o. (PEJ)

Verification of the following safety analyses of the first Polish NPP:

-

Deterministic safety analyses for the reference nuclear power unit.

-

Probabilistic safety analyses for the reference nuclear power unit.

-

Deterministic safety analyses for the nuclear power unit of the first Polish NPP taking into account site characteristics.

-

Probabilistic safety analyses for the nuclear power unit of the first Polish NPP taking into account site characteristics.

Preparation of the PSAR in a scope consistent with IAEA publication No. SSG-61 “Format and Content of the Safety Analysis Report for Nuclear Power Plants,” and the requirements of the Regulation of the Council of Ministers referred to in Article 36d item 3 of the Atomic Law Act of 29 November, 2000.

2021 - 2022

Resilience of the nuclear sector in Europe in the face of pandemic risks

Client: European Commission - DG ENER

The scope covers all the EU countries hosting nuclear installations, including a specific focus on those used in radioisotope supply chains. Using a country-by-country approach, with detailed examples and case studies to illustrate the situation, the analysis (i) identify in detail the critical issues at stake; (ii) describe the main problems encountered, and the measures taken;(iii) assesses their effectiveness, highlight good practices and develop recommendations for future action:

-

Determine the key challenges influencing the availability of nuclear generation capacity under enduring or new pandemic conditions,

-

Identify the critical supply chains essential for safe operations and maintenance of the nuclear facilities,

-

Ascertain the near-term impacts on availability of fuel supplies,

-

Assess the economic impacts of the pandemic on the prospects of new and existing planned nuclear investment projects.

2017 - 2018

Study on market for decommissioning nuclear facilities in the European Union

Client: European Commission

On behalf of the European Commission, NucAdvisor has performed the Study on market for decommissioning nuclear facilities in the European Union. The purpose of the Technical Audit was :

-

Characterize in detail the functioning of the European nuclear decommissioning market,

-

Evaluate the consequences of its development on the European Economy (employment, identification and typology of involved companies)

-

Identify the potential barriers to ensure the highest standards for safety and cost competitiveness

2014 - 2015

Audit of the gross cost assessment methods allowing the calculation of provisions for the deconstruction of EDF reactors during operation

Client: Minister in charge of Energy via the Department of Energy and Climate (DGEC)

The main objective of this audit is to analyze and discuss the sufficiency and degree of prudence of the gross charges and provisions concerning the decommissioning of the nuclear fleet in operation.

-

Checking the validity of the load assessment method

-

Control of the methods used for the management of residual technical uncertainties and the vagaries of the implementation of dismantling projects (PRA),

-

Comparison with other national and international studies and projects

Since 2013

Decommissioning and waste management expertise

Client: French Nuclear Commission (CEA)

Since 2013, NucAdvisor provide decommissioning and waste management expertise to the CEA for its different projects

-

Decommissioning planning

-

D&D risk assessment

-

Analysis/Optimization of D&D waste streams

-

Radioactive Waste treatment and storage solutions

-

D&D Cost Analysis and optimization

2018 -2019

Benchmarking Analysis of Member States Approaches to Definition of National Inventories Radioactive Waste and Spent Fuel

Client: European Commission

The large disparity of approaches for drafting the radioactive waste and spent fuel inventories made the European Commission to consider the implementation of a benchmarking study in order to assess the adequacy of the methods used by Member States and identify the best practices to spread across European Union.

NucAdvisor conducted the study to assess whether these approaches are consistent and in line with the challenges faced by radioactive waste and spent fuel inventories in the EU.

The implementation of this study was done through a Member State exhaustive analysis (national documentation, questionnaires…), followed by detailed benchmarking.

2019 - 2025

Audit of the French Atomic Energy Commission (CEA) nuclear installations dismantling & decommissioning plan and recovery and conditioning plan for old waste

Client: Minister in charge of Energy via the Department of Energy and Climate (DGEC)

%20-%20DGEC.png)

The main objective of this audit is to analyse the robustness and degree of prudence of the gross charges and provisions concerning the decommissioning of the nuclear fleet in operation.

The objective of this audit was :

-

Ensure the reliability of the operators' internal assessments on which the decommissioning funds are based;

-

Ensure the consistency of the annual subsidy allocated to the CEA for D&D projects with a view to optimising public spending;

-

Assess and control the methods used to manage residual technical uncertainties and project implementation contingencies

-

Such an audit is performed on several facilities every year

2019

Strategic study on radioactive waste and management routes for different EU countries (Switzerland, Germany, Belgium, Spain, Italy, United-Kingdom)

Client: Large operator

The objective of the project was to assess the European market for a waste treatment process. The contract has been performed in three different steps:

-

Determination of the context of each country (current inventory, management routes, stakeholders, content of the national inventory, future inventories…);

-

Identification of the waste families that could be treated with the treatment process, and detailed description of the physical and chemical characteristics of these wastes;

-

Assessment of the competing technologies and the storage/disposal installations.

2024 - ongoing

Consultancy services associated with review of design documentation justifying safety of IGNALINA nuclear power plant equipment dismantling, decontamination and radioactive waste management

Client: VATESI

NucAdvisor leading* high level consultancy services within a framework contract to cover the following objectives:

-

Review of design option reports for the dismantling of the INPP Units 1 and 2 reactor cores (R3 zones) and additional documents related to this documentation;

-

Review of conceptual designs for the dismantling of INPP Unit 1 and 2 reactor cores (R3 zones) and additional documents related to this documentation;

-

Review of a description of the dismantling project of INPP Unit 1 and 2 reactor cores (R3 zones) equipment and the safety analysis report of this project and additional documents related to this documentation;

-

Review of the technical design and safety analysis report for the construction of the INPP reactor waste interim storage facility (RWISF) and additional documents related to this documentation;

-

Review of description and safety analysis report of the dismantling project of steam drum-separators and related systems of INPP Units 1 and 2 and additional documents related to this documentation;

*NucAdvisor is leading the consortium ASNR, Bureau Veritas and Egis Nuclear Services

2024 - 2025

Review of the HFR Decommissioning Plan 2022

Client: European Commission – Joint Research Center (JRC)

The objective of the project was to analyze the Decommissioning Plan (DP) 2022 for the High Flux Reactor (HFR), focusing on its exhaustiveness and feasibility. The study consisted of three separate tasks to cover all aspects of the DP-2022 and provide a comprehensive contract and structural organization recommendations to address the challenges ahead.

1. Task 1: Evaluation of Cost Estimates and Risks:

-

Evaluation of the cost estimates, schedule plausibility, and associated risks.

-

This led to significant budget revisions and highlighted critical gaps and uncertainties.

2. Task 2 : Implications on JRC’s Organisation.

-

Exploration of different program organizations and implementation scenarios.

-

Recommendation of plausible scenarios from the perspective of the JRC.

3. Task 3: Assessment of Liability Transfer:

-

Assessment of the practicality of transferring decommissioning and radioactive waste management liabilities.

-

Analyzed relevant legal and regulatory frameworks, stakeholder interfaces, and financial arrangements.

The findings and recommendations aimed to ensure a structured, efficient, and cost-effective decommissioning process, minimizing risks and uncertainties for the JRC.

2022 – ongoing

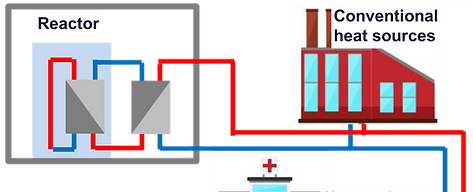

Feasibility study for an innovative design of nuclear reactor for district heat supply, CALOGENA

Client: CALOGENA

In the frame of the French vision of 2030, the government published a call for tender to develop an innovative nuclear reactor. NucAdvisor invested in developing a new small nuclear reactor (CalogenaTM) based on pool-type research reactor technology with complementary patentable features to ensure the reactor's safety.

As fossil fuels still dominate the district heating, network decarbonising is largely untapped. CalogenaTM aims to produce heat to substitute the current production sources within the European territory to align the clean energy vision by 2050. Calogena's target power is 30 MWth, a 60 MWth version is possible by using two 30 MWth reactors sharing all their auxiliary systems, including their cooling and fuel storage pools. The reactor can provide an output temperature between 70°C & 100°C. This feature allows Calogena to adapt to the network sizes and fit the 4th heating network generation.

NucAdvisor provides a wide range of support activities, related to PMO, quality assurance, reactor design, use of computational codes

2021 - ongoing

Support to the development of NUWARD

Client: EDF then NUWARD

As part of the development of its activities, EDF and later its subsidiary NUWARD, have selected NucAdvisor as a technical reference in the nuclear sector. To date, NucAdvisor has supplied expert advice on:

-

Opinion on the technical position of the project on codes and standards, and support for the definition of a robust strategy for FOAK and export.

-

Analysis of regulations and national/regional practices outside France

-

Technical expertise in certain studies and certain developments of the NUWARD project through the technical analysis of project deliverables, participation in periodic project reviews and other technical reviews initiated by the project team.

-

Assistance to the project director and support for the project's future technical director, his presence in international bodies, his dialogue with other safety authorities.

-

Participation in lobbying and communication actions in liaison with partners for the promotion of the NUWARD project

2022 - ongoing

Support to the development of Jimmy Energy’s high temperature reactor

Client: Jimmy Energy

As part of the development of its activities, Jimmy Energy has selected NucAdvisor as a technical reference in the nuclear sector, and in particular that of SMRs, to assist it in the design maturation phase and to contribute to the validation and quality of its HTR SMR.

To date, NucAdvisor has supplied expert advice about the following:

-

Reactor core design;

-

Overpressure accident study;

-

Codes and standards for CPP materials;

-

Component qualification;

-

Behaviour of materials under irradiation;

-

Licensing documentation;

-

Design review of the reactor;

-

Cost estimation

2021 - ongoing

Assistance to the development of Newcleo's Lead Fast Reactors, LFR 30 & 200

Client: NewCleo

Newcleo is an Italian start-up company growing at a fast rate, with subsidiaries in France and the UK. It is promoting the Lead Fast Reactor technology in 2 sizes: the LFR 30 AS reactor and the bigger LFR 200 one. Both designs use MOX fuel and Newcleo has requested NucAdvisor to assess the possibility to re-use the MOX fuel assemblies from Superphenix core 2. These old fuel assemblies were not irradiated in Superphenix due to the government’s decision in 1998 to close, decommission and dismantle the facility. This request has led NucAdvisor to tackle various technical challenges:

-

Define various handling routes for these fuels and assess technological hard points,

-

Evaluate various core designs suitable for these fuels with “non classical” radionuclide and isotopic contents.

NucAdvisor is also advising Newcleo on the licensing and R&D activities of its reactor programs, and on some specific requirements of the BPI France 2030 call for projects.

2023 - ongoing

Technical Due Diligences

Client: NAAREA

NAAREA is a young French start-up promoting a small, versatile molten salt reactor: the XSMR. It has successfully submitted a file to the BPI France 2030 call for projects in mid-2022. NAAREA’s CEO has requested NucAdvisor to perform Technical Due Diligences of the XSMR according to 5 technical topics :

-

Reactor physics (fast spectrum) and conceptual design

-

Chemical problems arising from salts (chlorides)

-

Materials, corrosion, French codes and standards

-

Nuclear material transformations (PuCl3) Such nuclear material is not used at the industrial scale in France

-

Safety and comparison of MSR safety analysis to PWR (the current safety regulation)

NucAdvisor’s project team has performed the due diligence at a fast pace and submitted its final report at the beginning of May 2023, and has performed a comprehensive update in 2024.

2024 - ongoing

Design support activities

Client: THORIZON

THORIZON is a Dutch start-up designing and promoting a small, versatile molten salt reactor. It has successfully submitted a file to the BPI France 2030 call for projects.

THORIZON design team has requested NucAdvisor to support their design activities related to safety approach

2011 - 2017

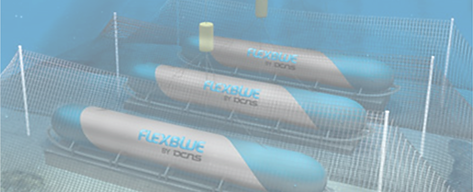

Consulting services for preliminary studies on SEANERGIE project, underwater mobile nuclear power generators

Client: Naval Group (ex DCNS)

NucAdvisor was a key part of the Naval Group in the subsea SMR project, carrying out a number of strategic studies to support the overall Project Feasibility. SEANERGIE project (Former FLEXBLUE) is a concept of a small subsea nuclear power plant based on proven technologies combined in a new way. NucAdvisor has supported Naval Group on subjects such as:

-

Compliance of the project with the legal, technical and licensing requirements, project governance

-

Market studies and business modelling, international partnerships

-

Site studies, site selection, stakeholder involvement and social acceptance analyses

-

Overall plant system design, and Reactor design assessment, safety studies

-

Studies on the interaction between module and environment

2020

Assessment of the global nuclear sector from the perspective of possible investment opportunities

Client: Confidential

NucAdvisor conducted a study for a client interested in investing in advanced reactor technologies.

-

The study presented an overview of the global nuclear power sector focusing on SMR technologies in order to provide a framework and baseline for further investigation of investment opportunities in the nuclear power sector worldwide

-

The economics of nuclear power plants are discussed together with a comparison of the cost of generating electricity from nuclear power plants compared to other generation sources.

2024

Survey on the PWR fresh fuel transport containers in Europe and the USA

Client: Confidential

Transportation of fresh fuel, which contain fissile material, is a highly regulated activity concerning the safety of the design, operation and maintenance of the containers, in compliance with IAEA SSR-6 and under the control and agreement of the EU regulatory bodies.

The survey is focused to bring answers to specialized questions or issues, based on available technical public documentation and studies regarding the design and operational experience of Framatome ANP FCC-4, ANP FCC-3, and ANF Lingen ANF-18 containers, for transport of enriched natural uranium (UNE) and enriched reprocessed uranium (URE) fresh fuel assemblies, and experience gained in France, Europe and US.

In our survey, have been includes, when available:

-

recent evolutions and updating regarding the transportation of fresh fuel in the European and United States framework,

-

later possible development of container project for fresh fuel assemblies.

A major part of our investigation has resulted from information analyzed in the light of the regulatory framework in France (IRSN technical analysis, ASN agreements), Europe (Spain CSN...) and US NRC (revalidation of certificate...), except possible proprietary details:

-

Presentation of the current overall use, agreements and licensing status,

-

General and specific issues covered by the safety analysis,

-

Methods of demonstration, experience and problems encountered,

-

Updating of agreements.

2022 - ongoing

Review and analysis of the transposition and implementation of the Basic Safety Standards provisions on Radiation Protection Experts (RPE), Radiation Protection Officers (RPO) and Medical Physics Experts (MPE) in the EU Member States

Client: European Commission – DG ENER

The objective of this study is to review and assess in detail the transposition and implementation of the requirements for Radiation Protection Experts (RPE), Radiation Protection Officers (RPO) and Medical Physics Experts (MPE) of the BSS Directive (Council Directive 2013/59), in the EU-27 Member States and in the United Kingdom, Norway and Switzerland. This study is intended to be an essential part of the transposition and conformity checks. It shall have a particular focus on the practical implementation of the Articles providing for the definition, roles and responsibilities, as well as education, training, and re-training of RPE, RPO and MPE as well as the detailed arrangements for their recognition. It shall assist the Commission in assessing compliance of the practical implementation of the legislative and administrative provisions for Radiation Protection Experts (RPE), Radiation Protection Officers (RPO) and Medical Physics Experts (MPE) in the EU Member States, with the requirements of the BSS Directive.

The specific objectives of this study are:

-

Review and detailed analysis of national legislative frameworks for RPE, RPO, and MPE as established by all EU Member States, the United Kingdom, Norway and Switzerland according to the requirements laid down in the BSS Directive

-

Review and detailed analysis of the practical implementation of the national frameworks including arrangements, structures and programmes for education, training, retraining and recognition of RPE, RPO and MPEs.

2021 - 2023

Implementation of nuclear and radiological emergency preparedness and response requirements in EU Member States

Client: European Commission

The European Commission has retained Consortium led by NucAdvisor to conduct a study on the “Implementation of nuclear and radiological emergency preparedness and response requirements in EU Member States :

-

Review and evaluate the practical implementation of national emergency preparedness and response arrangements

-

Provide information on the effectiveness of arrangements and capabilities

-

Share national experiences amongst the relevant authorities and highlight effective practices that would improve public confidence

-

Review and analyze the coherence of these arrangements in a cross-border context in various scenarios

-

Develop recommendations for future policy actions at the EU level to improve implementation practices.

2021 - 2023

Study on monitoring of radioactive discharge from nuclear facilities in the EU

Client: European Commission

This study focuses on the facilities that have the authorisation to discharge a significant amount of radioactivity in the environment and are required to have technical systems in place to carry out continuous or batch-wise monitoring of these discharges.

During this study, eleven nuclear facilities in nine Member States (covering nuclear power plants from different technologies, spent fuel reprocessing plant, medical isotope production facilities and a nuclear plant under dismantling) were visited for a detailed assessment of the monitoring of liquid and gaseous radioactive discharge systems.

The report provides an overview of the best practices, underlines suggestions for further development, and evaluates the Recommendation 2004/2/Euratom issued by the European Commission on standardised information on radioactive airborne and liquid discharges.

2020 - 2021

Safety-related support services for the Low Power Research Reactor LPRR (Saudi Arabia)

Client: King Abdulaziz Center of Science and Technology (KACST)

King Abdulaziz City for Science and Technology (KACST) is a Saudi Arabia government institution that supports and enhances scientific applied research. The Nuclear Science Research Institute (NSRI) of KACST is nearing completion of a research reactor constructed in Riyadh.

NucAdvisor supported the LPRR project team and conducted a review of Safety and Licensing documents, defining the set of recommendations for licensing documentation, and highlighting the main strengths and weaknesses of the design and operation

2018 - 2019

Security-related support services for the Low Power Research Reactor LPRR (Saudi Arabia)

Client: King Abdulaziz Center of Science and Technology (KACST)

King Abdulaziz City for Science and Technology (KACST) is a Saudi Arabia government institution that supports and enhances scientific applied research. The Nuclear Science Research Institute (NSRI) of KACST is nearing completion of a research reactor constructed in Riyadh.

NucAdvisor supported the LPRR project team through consultancy services and defined and assess malevolent acts which could result in exposure to, or dispersion of radioactive materials.

Nuclear medicine :

2017 - 2023

Technical support for due diligences in the nuclear medicine sector (multiple projects)

Client: Different clients

NucAdvisor contributed as a technical advisor for different due diligence projects over the past years, for major investments in either production installations or buyouts of radioisotopes and radiopharmaceutical players.

Namely, NucAdvisor implemented the following tasks:

- Evaluation of capital expenditures for future investment related to nuclear safety in medical radioisotopes and radiopharmaceuticals installations,

- Evaluation of operational expenditures, including maintenance costs for radioisotopes production equipment,

- Evaluation of industrial production efficiency,

- Radioisotopes/Radiopharmaceuticals market analysis, including supply chain maps, strategic analysis of the main players, estimation of the market, demand and supply, analysis of the market risks from an investor point of view and development of market scenarios, etc.

2022

Review & assessment of manufacturing options for a new therapeutic radiopharmaceutical

Client : Radiopharmaceutical player

An industrial player developing therapeutic radiopharmaceuticals with a Phase III trial expected to start within the next years, contacted NucAdvisor to get a review & assessment of the various options that exist in terms of the framework under which a Phase III, and therefore also commercial therapeutic RP product, can be manufactured. Focus is to be made on US and EU.

Different options were assessed in detail, in terms of a pros and cons analysis, cost aspects, manufacturing locations, and other relevant parameters:

- Full outsourcing,

- Build, own and run its facility,

- Investment in an existing manufacturer for a dedicated suite & resources,

- Revenue share approach,

- Out-licence or in-license; etc.

Additionally, the assessment considered the pros and cons of the therapeutic product being made from a kit-type format in decentralized radio-pharmacies, as opposed to the more commonly implemented centralised manufacturing model.

2022 - 2024

SAMIRA study on the implementation of the Council Directive 2013/59/Euratom requirements for medical equipment with respect to monitoring and control of patient’s radiation exposures

Client : European Commission - DG ENER

As part of the SAMIRA actions in the area of Quality and Safety of medical applications of ionising radiation, this study will contribute to supporting the implementation of high standards for quality and safety in Member States’ health systems. This study will specifically address the implementation of the Council Directive 2013/59/Euratom requirements for medical radiological equipment, concerning controlling, recording and reporting patients’ radiation exposures.

Main tasks implemented:

- Collect and analyse up-to-date information on the implementation of the Council Directive 2013/59/Euratom requirements for medical radiological equipment, for controlling, recording and reporting of patients’ radiation exposures.

- Develop best-practice guidance on the implementation of these requirements.

- Discuss the results of the work with Member States, with the view of stimulating further national and EU-level efforts in this area.

2017 - 2019

Study on Sustainable and Resilient Supply of Medical Radioisotopes in the EU (SMER)

Client: European Commission – DG JRC

The objective of this study was to provide the Commission with information on the diagnostic nuclear medicine market in the EU, focusing on 99Mo/99mTc generators.

In a fully complementary manner to the SAMIRA study, the SMER study focused upon :

- Downstream part of the 99mTc supply chain: from the generators manufacturing up to the end-users, with a highlight on the Member States Health systems reimbursements and possible impacts on the sustainable supply of radioisotopes.

- The efficiency of existing reserves in the use of 99mTc and focuses on how the different public health systems in the EU deal with diagnostic procedures based on the use of 99mTc, and how the organization of health care and the reimbursing scheme may affect the efficient and economically sustainable use of 99Mo/99mTc generators.

2022 - ongoing

Framework service contract for technical, scientific, administrative and logistical support for the SAMIRA Action Plan implementation

Client : European Commission - DG ENER

In early 2021, the Commission published a Staff Working Document on a Strategic Agenda for Medical Ionising Radiation Applications (SAMIRA). The SAMIRA initiative is the energy sector's contribution to Europe's Beating Cancer Plan and a response to the Council’s conclusion on non-power nuclear and radiological technologies and applications. The SAMIRA Action Plan includes specific proposals in three priority areas:

- Supply of radioisotopes,

- Quality and safety of medical ionizing applications,

- Innovation in medical applications.

The implementation of the SAMIRA Action Plan will require continuing support from EU budgets in the areas of Energy, Health and Research, with the objective of coordination and integration of activities across policy areas. The objective of this contract will be to ensure technical, scientific, administrative and logistical support to DG ENER for the implementation of the SAMIRA Action Plan.

2020 - 2021

Co-ordinated approach to the development and supply of radioisotopes in the European Union

Client : European Commission - DG ENER

The objective of this study was to fill the gaps in the available information on the supply chains for the main established and novel radioisotopes that have, or are expected to have, significant uses in Europe.

This work paved the way for long-term European cooperation in this area. The study focused on:

- The identification of currently used radioisotopes and those which are expected to be in use in the near future for medical and industrial applications,

- The identification of existing and emerging methods and technologies for radioisotopes production, and an evaluation of corresponding supply chains for identified radioisotopes,

- The analysis of current European supply chain players and their associated installations, and the identification of upcoming threats and limitations,

- The development of scenarios and concrete options for a sustainable and secure supply of radioisotopes in the EU. Link to publication - https://op.europa.eu/s/xH3Q

2023

Nuclear compliance audits of radiopharmaceutical installations (Asia)

Client : Confidential

NucAdvisor performed compliance audits in different radiopharmaceutical manufacturing sites (for PET, SPECT and therapeutic applications) to review its current regulatory status (national and international) and evaluate the capacity to maintain long-term compliance with nuclear regulatory requirements. The analysis included:

- Evaluation of licensing situation (existing licenses, authorisations) to highlight the current limitations (e.g., expiry, renewal process, current licensing constraints, etc.)

- Evaluation of radioactive waste management onsite and offsite

- Evaluation of transport and logistics risks (e.g. record of radioactive materials, national nuclear transport regulation compliance)

- Review of radiological protection processes for employees, members of the public and the environment (e.g., review of dose registries, staff incidents, ALARA strategy, etc.)

- Review of past events (incidents and accidents), mitigation measures taken (if any), and emergency planning and preparedness considerations.

- Evaluation of site considerations (e.g., site boundaries, physical security, etc.)

- Review of internal safety organisation and safety documentation,

- Review of internal inspection programmes results, corrective actions taken (if any) and their implementation.

2023

Isotopes Strategic Overview for 177Lu and 176Yb

Client : Confidential

NucAdvisor supported a large industrial player in the enrichment sector to underpin their strategic vision by performing a strategic analysis of this business and propose recommendations leveraging existing government support (Europe and US) for building new capabilities, partnering (JV/ collaboration) or just be a supplier/customer.

NucAdvisor analysis included:

- For each potential partner and country, client wanted to understand what irradiation and or processing capability next to a reactor already exists.

- For each reactor (research or power ), client wanted to get general specifications and basic details plus openness to collaboration and partnerships, existing collaboration and partnerships, medical isotopes experience, irradiation capability, production and products, challenges and opportunities, and point of contact.

- An evaluation of the global irradiated 176Yb processing capability: in which countries, which alignment, partnerships and customers? Which operating models? Which deployability, complexity, and chances of success. What about the same processing capability used to process other isotopes? Are modifications required?

2023 - ongoing

Feasibility study and further analyses of the legal, economic and organisational options for establishing European Radioisotope Valley Initiative (ERVI)

Client : European Commission - DG ENER

The SAMIRA Action Plan foresees the establishment of a European Radioisotope Valley Initiative (ERVI) aiming, in the long-term, to maintain Europe's global leadership in the supply of medical radioisotopes, reduce dependencies on foreign suppliers and help accelerate the development and introduction of new radioisotopes and production methods.

This study aims to define and evaluate the possible options for establishing the European Radioisotope Valley Initiative (ERVI), in line with the objectives proposed in the SAMIRA action plan.

In order to achieve this general objective, the study hereby procured will:

- Develop six “ERVI projects” for further analysis.

- Conduct feasibility studies of the ERVI projects.

- Analyse the available options for establishing ERVI.

- Develop an ERVI basic design.

2024

Analysis of European PET radiodiagnostic tracer market

Client : Confidential

NucAdvisor supported a large industrial player in PET radiotracer market to underpin their strategic vision by performing a strategic analysis of the European PET market business and its expected evolution over the next decade.

NucAdvisor analysis included:

- Pricing considerations in Europe for FDG, FCH and novel radiodiagnostic tracers like PSMA, FAPi and GRPR

- Reimbursement considerations in Europe for PET tracers, including analysis of the public and private insurance schemes for different countries

- Analysis of manufacturing and competitive considerations

- Analysis of PET radiodiagnostic products under development (i.e. exhaustive analysis of products under development), including Neurology

- Evaluation of PET scanner installed base in Europe

2025

Business Case Support

Client : Confidential

The client is a private investment fund considering a large investment in an irradiation and processing plant.

NucAdvisor analysis included:

- Evaluation of current and future global demand per radiochemical and radiopharmaceuticals, including market prices and trends. This was performed through a mapping of diagnostic and therapeutic radiopharmaceuticals under development (market entry, mapping of clinical needs, cancer incidences, …)

- Evaluation of irradiation and processing international landscape and competitive framework, including an evaluation of each player competitive position and likelihood of success for new projects

- Evaluation of healthcare systems capabilities to sustain a global increase of radiopharmaceutical use over the next decades,

- Analysis of business case, including preparation of new scenarios for market evolution, review of input parameters and long-term evolution.

2017- 2019

Study on Sustainable and Resilient Supply of Medical Radioisotopes in the EU (SMER)

Client: European Commission

Complementary to the SAMIRA project, the SMER study focuses upon the downstream part of the Tc-99m supply chain: from the generators manufacturing up to the end-users.

NucAdvisor assessed the efficiency of existing reserves in the use of Tc-99m, and focused on how the different public health systems in the EU deal with diagnostic procedures based on the use of Tc-99m, and how the organization of health care and the reimbursing schemes may affect the efficient and economically sustainable use of Mo-99/Tc-99m generators.

The public report can be found by following the link below:

https://publications.jrc.ec.europa.eu/repository/handle/JRC128401